Table of Contents

Design software leader Figma has taken a significant step towards its long-awaited initial public offering (IPO), filing an updated prospectus that outlines key financial terms and demonstrates robust business momentum. The company anticipates selling approximately 37 million shares at a price range of $25 to $28 per share. This pricing strategy could generate up to $1 billion in total proceeds, shared between Figma itself and existing selling shareholders. Crucially, at the high end of this range ($28 per share), Figma could achieve a fully diluted valuation of approximately $16.4 billion, marking a notable increase from its $12.5 billion valuation in a 2024 tender offer. This potential $16 billion+ public market debut stands in contrast to the $20 billion acquisition offer from Adobe in 2022, a deal ultimately abandoned due to regulatory objections. Leading the company into this new phase is co-founder and CEO Dylan Field, who plans to sell 2.35 million of his own shares, potentially netting up to $65.8 million.

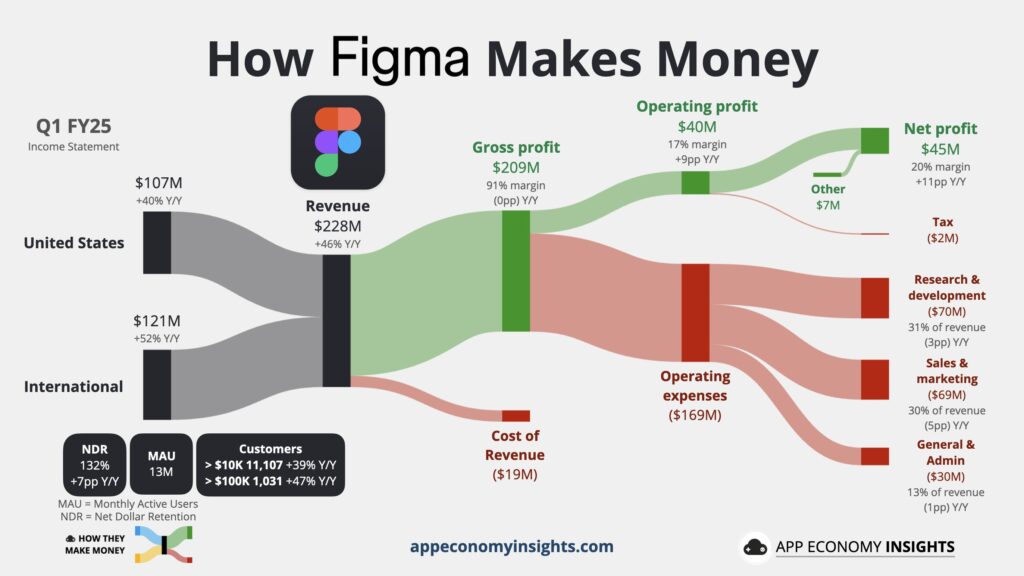

Alongside the IPO terms, Figma released preliminary financial results for the second quarter of 2024, signaling continued strong performance. The company expects revenue between $247 million and $250 million, representing impressive year-over-year growth of 39% to 41%. This follows an even higher growth rate exceeding 46% in the first quarter. Figma attributes this growth to both acquiring new clients and expanding relationships with existing ones. Preliminary operating income is projected between $9.0 million and $12.0 million. More significantly, this points to an operating margin improving to 4% to 5%, up from 3% in the same quarter last year, indicating progress towards profitability on its operational income. Figma officially filed for its IPO on July 1st and intends to list on the New York Stock Exchange under the ticker symbol “FIG.”

Blockchain Intrigue, Board Additions, and a Thawing IPO Market

Beyond the core financials, Figma’s updated filing revealed intriguing, albeit cautious, exploration of blockchain technology. The company disclosed it has authorized the creation of a new class of “blockchain common stock,” which would be issued as “blockchain-based tokens.” However, Figma explicitly stated it currently has “no plans to issue blockchain common stock,” leaving the purpose and future of this authorization unclear. This disclosure follows Figma’s July announcement of investments in a stablecoin and a Bitcoin exchange-traded fund (ETF), suggesting an ongoing strategic interest in the cryptocurrency space despite the lack of immediate plans for tokenized stock.

Figma is also strengthening its board of directors ahead of the public listing. Mike Krieger, the co-founder of Instagram and current Chief Product Officer at AI model developer Anthropic, has joined the board. He is joined by Luis von Ahn, the co-founder and CEO of language-learning platform Duolingo. These appointments bring significant technology leadership and public company experience to Figma’s governance. The IPO attempt comes amidst a broader, albeit tentative, reopening of the market for technology company listings after a significant slowdown since late 2021. Investor caution driven by inflation concerns and recession fears had dampened enthusiasm for high-growth companies, particularly those not yet profitable. However, Figma’s filing follows recent debuts by other tech firms, including cloud infrastructure provider CoreWeave in March, and fintech companies Circle (stablecoin issuer) and Chime (digital bank) in June, suggesting a potential thaw in the IPO winter and renewed investor appetite for select tech offerings. Figma’s strong growth metrics and improved margins position it as a key test case for this market resurgence.

Figma Targets $16.4 Billion Valuation in NYSE IPO, Bolstering Tech Listing Hopes

Figma is poised for a significant initial public offering (IPO) on the New York Stock Exchange, aiming for a fully-diluted valuation of up to $16.4 billion. This highly anticipated debut has the potential to energize the tech IPO market, which is showing signs of recovery. According to its Monday statement, the San Francisco-based design software leader, along with some of its investors, plans to raise approximately $1.03 billion by offering nearly 37 million shares priced between $25 and $28 each. This IPO represents a pivotal moment for Figma, arriving over a year after its proposed $20 billion acquisition by Adobe collapsed due to regulatory objections in the UK and Europe. The broader market’s recent rebound, coupled with successful tech listings like stablecoin issuer Circle, has renewed optimism for new offerings. Figma’s upcoming market entry is already attracting considerable attention, amplified by its notable stance on bitcoin and related social media buzz. The company’s filing reveals it held a $70 million investment in Bitwise’s bitcoin exchange-traded fund (ETF) as of March 31st and intends to invest an additional $30 million, underscoring its commitment to cryptocurrency exposure as it transitions into a publicly traded entity. This move positions Figma as a key test case for the returning appetite for growth-oriented tech stocks