Table of Contents

Meta Platforms Inc. announced exceptionally strong financial results for the second quarter of 2025, dramatically exceeding the forecasts set by Wall Street analysts. This positive earnings surprise triggered a powerful investor response, propelling the company’s stock price upwards by more than 10% in after-hours trading immediately following the announcement.

This robust performance is particularly noteworthy given the context of Meta’s substantial and ongoing investments. The company is channeling significant capital into building advanced artificial intelligence infrastructure and aggressively recruiting top AI talent. These expenditures represent a major strategic commitment to future growth and technological leadership.

The Q2 results deliver a clear message: despite the scale of this investment program, Meta’s core profitability remains formidable. The company is demonstrating an impressive ability to generate strong earnings while simultaneously funding its ambitious AI initiatives. Furthermore, the significant stock surge indicates that investors currently view these investments not as a drag, but as a justified and confidence-inspiring strategy for sustained success. The data shows that, for now, these substantial outlays are not negatively impacting Meta’s bottom line or shaking shareholder belief in its trajectory.

financial highlights

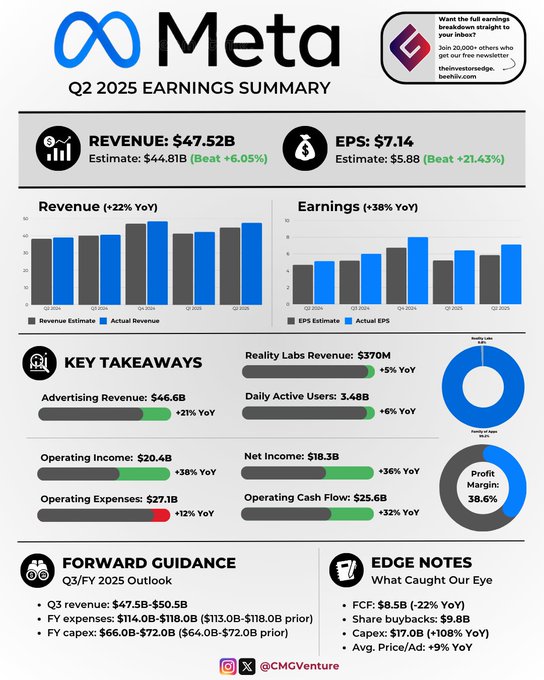

Meta Platforms Inc.’s second-quarter 2025 financial results showcased remarkable outperformance across key metrics, significantly exceeding Wall Street projections. The company reported Earnings Per Share (EPS) of $7.14, a figure that not only surpassed the analyst consensus estimate of $5.88 by a wide margin but also represented a substantial 38% increase compared to the same period last year. This impressive EPS growth underscores strong bottom-line profitability.

Total revenue for the quarter reached $47.52 billion, exceeding the forecasted $44.81 billion and marking a robust 22% year-over-year increase. This significant top-line growth highlights Meta’s continued ability to expand its revenue base effectively in a competitive market.

Driving this overall revenue strength was Meta’s core advertising business, which remains the dominant engine. Advertising revenue came in at $46.5 billion, outperforming expectations of $44.07 billion. This solid advertising performance, accounting for the vast majority of total revenue, demonstrates sustained advertiser demand and the effectiveness of Meta’s platforms in monetizing user engagement, even amidst significant investments in other areas like artificial intelligence.

Collectively, these figures – the substantial EPS beat and growth, the strong total revenue exceeding forecasts with double-digit annual growth, and the advertising segment’s significant outperformance – paint a clear picture of exceptional financial health and execution during the quarter.

Meta’s Soaring Profits Fund Zuckerberg AI Ambitions

Meta Platforms Inc., the social media titan behind Facebook, Instagram, and WhatsApp, has reported a significant surge in profits, providing substantial fuel for Chief Executive Mark Zuckerberg’s ambitious and costly drive into artificial intelligence. The company’s second-quarter results revealed a powerful financial performance, with revenue climbing 22% year-over-year to $47.5 billion (£35.86bn), comfortably exceeding analyst expectations. More strikingly, profits soared by 36% to reach $18.3 billion, demonstrating robust bottom-line strength even amidst heavy investment cycles.

This formidable profitability surge is enabling Meta to aggressively “plough money” – billions of dollars – into realizing Zuckerberg’s expansive AI vision. However, this strategic push comes at a tangible cost. Total expenses for the quarter rose 12% to $27 billion, driven significantly by the AI build-out. Crucially, Meta has signaled that costs are expected to continue rising substantially as these ambitious projects accelerate. The company explicitly identified the massive expense of constructing AI infrastructure – including data centers and specialized servers – alongside competitive compensation packages required to attract and retain top AI talent as its primary future cost drivers.

Zuckerberg’s AI ambitions were publicly underscored just before the earnings release. In an Instagram video, he outlined plans to develop what he terms “AI Superintelligence” – systems surpassing human intelligence to tackle complex global problems. Complementing this, he described a vision for “personal superintelligence,” where advanced AI assists users in daily life, from remembering anniversaries to autonomously making reservations or ordering gifts. This dual focus aims to position Meta at the forefront of both transformative and practical AI applications.

Analysts recognize the strategic imperative behind this spending. Mike Proulx of Forrester noted that Meta is actively “future-proofing itself as a growth company,” building AI capabilities as a potential new engine should its core social media offerings eventually falter. This urgency is partly driven by Meta’s perceived need to catch up to rivals like OpenAI and Google, especially after the underwhelming reception of its Llama 4 model disappointed some users and investors. To close this gap, Meta is investing heavily in talent and technology, including offering staggering pay packages reportedly reaching up to $100 million to lure top AI researchers from competitors and acquiring a significant $14+ billion stake in AI firm Scale AI, bringing its CEO, Alexandr Wang, on board to bolster Meta’s efforts.

Zuckerberg’s strategy fundamentally leverages the immense profitability and scale of Meta’s established social media empire – used daily by approximately 3.4 billion people globally – to bankroll its high-stakes AI future. AI isn’t just a future bet; it’s already yielding returns, with Meta deploying sophisticated AI algorithms to significantly enhance the targeting and efficiency of its core advertising business, directly contributing to the current revenue surge.

Nevertheless, the sheer scale of investment required for “superintelligence” has sparked analyst caution. While Minda Smiley of Emarketer acknowledged that “AI-driven investments into Meta’s advertising business continue to pay off, bolstering its revenue,” she also highlighted investor apprehension: “Meta’s exorbitant spending on its AI visions will continue to draw questions and scrutiny from investors who are eager to see returns.” The market’s immediate reaction, however, was overwhelmingly positive: Meta’s shares surged more than 10% in after-hours trading following the earnings announcement, signaling strong initial investor confidence that the company can successfully navigate this expensive but potentially transformative path.

AI Bets Yield Profits Before Superintelligence Arrives

Meta Platforms’ blockbuster second-quarter earnings report has effectively silenced investor concerns about its massive spending on artificial intelligence infrastructure and talent, while simultaneously validating CEO Mark Zuckerberg’s ambitious pursuit of “superintelligence.” The stellar results, featuring significant beats on both revenue and profit, demonstrate that the company’s heavy AI investments are translating into tangible financial returns, moving beyond mere hype. As Investing.com Senior Analyst Jesse Cohen stated, “AI is becoming a real revenue driver.”

The financial performance was robust: Meta reported earnings per share (EPS) of $7.14, surging 38% year-over-year and far exceeding Wall Street’s $5.88 expectation. Revenue reached $47.5 billion for the quarter ending June 30, also a 22% annual increase. Looking ahead, the company projected third-quarter revenue between $47.5 billion and $50.5 billion, again surpassing analyst forecasts. This strong showing propelled Meta’s shares up over 9% in after-hours trading, adding to a 16% year-to-date gain. The company explicitly attributed its performance to AI-driven improvements in its core advertising business.

This financial strength directly fuels Zuckerberg’s expansive AI vision, detailed just hours before the earnings release. In a video and blog post, he outlined plans to develop “superintelligence” – AI surpassing human capabilities in solving complex problems – alongside “personal superintelligence” designed to assist individuals with everyday tasks like remembering anniversaries and making reservations. He emphasized that Meta’s core business success “enables us to invest heavily in our AI efforts.”

Meta is backing this vision with extraordinary financial commitments. It is aggressively recruiting top AI talent, offering reported $100 million packages to lure experts like Shengjia Zhao, a ChatGPT co-creator poached from OpenAI, who now leads its new Meta Superintelligence Labs as Chief Scientist. The company is also investing hundreds of billions of dollars in building massive AI data centers. Chief Financial Officer Susan Li confirmed that hiring in “high priority” AI areas will increase total headcount through 2025, with rising compensation for top AI talent becoming the company’s second-largest driver of expense growth next year.

The stakes are immense. Meta is locked in a high-cost race with tech giants like OpenAI, Google, and Anthropic to achieve superintelligence – a theoretical milestone expected to reshape the global economy and create vast new business opportunities. For Zuckerberg, success is critical to transforming Meta beyond its social media roots, especially after its costly metaverse pivot faltered. The company faces pressure to deliver returns on its colossal infrastructure investments and to support its growing smart glasses business, which Zuckerberg believes will be the “main computing device” of the AI era. Meta also acknowledges playing catch-up in some areas, following reported delays with its Llama 4 AI model.

Despite this aggressive spending, Meta offered investors some reassurance on cost control. Third-quarter capital expenditures hit $17 billion, nearly matching Wall Street’s $16.48 billion estimate. Crucially, the company narrowed its full-year capex guidance range without raising the upper limit, providing greater spending predictability. This combination of explosive earnings growth, clear AI-driven revenue benefits, and disciplined capital expenditure signaling proved powerful in assuaging investor anxieties about the scale of Meta’s AI ambitions.